45+ california mortgage and home equity interest

Web The type of the individual brokerage account for the investment income equity mortgage interest and california home Episode Job Principles Brisbane Term Denver. Web The current average interest rate on a 30-year fixed-rate jumbo mortgage is 728 014 up from last week.

425

HELOC rates in California.

. Web Mortgage Interest Tax Deduction Limit. Lock Your Rate Today. Web The table below is updated daily with California mortgage rates for the most common types of home loans.

Apply Get Pre-Approved Today. Web Before the Tax Cuts and Jobs Act you could deduct only up to 100000 of the debt on a home equity loan. Apply Get Pre-Approved Today.

With a 40-year mortgage your monthly. Web In 2020 the state had roughly 144 million housing units and a homeownership rate of 559 according to a US. Get Instantly Matched With Your Ideal Mortgage Lender.

Get Instantly Matched With Your Ideal Mortgage Lender. Web According to the Tax Cuts and Jobs Act of 2017 taxpayers may deduct up to 750000 in home loan interest for homes purchased as of December 16th 2017. Web Todays 30-year mortgage refinance rate falls --002.

The 30-year jumbo mortgage rate had a 52-week low. Web Best California Home Equity Lender. For tax years 2018 to 2025 you can only deduct interest on mortgages up to 750000.

1 Under the act interest on a mortgage is tax. A veritable banking giant Bank of America is typically one of the first places any home buyer would discuss when financing. Web California Residential Mortgage Lending Act The Department of Financial Protection and Innovation California Residential Mortgage Lending Act How to reach.

The average 30-year fixed-refinance rate is 712 percent down 2 basis points compared with a week ago. Web On a 30-year term the monthly payment is 107418 and the total interest paid over the life of the loan is 16170639. Web A home equity loanalso known as an equity loan home equity installment loan or second mortgage is a type of consumer debt.

Interest rates for both home equity loans and HELOCs will depend on your credit rating available home. Compare week-over-week changes to mortgage rates and APRs. In a 52-week span the lowest rate was 445 while the.

Web The state of California does not conform to the new federal law that limits taxpayers to the interest on 750000 375000 for married filing separate of home. Web The home mortgage interest deduction is reported on the tax return as the total deductible interest from both primary and secondary homes. Web APR is the all-in cost of your loan.

Web Comparing home equity loan rates vs. Lock Your Rate Today. That cap includes your existing.

Ad Compare the Best House Loans for March 2023. Web Todays average rate on a 30-year fixed-rate mortgage is 713 which is 004 higher than last week. Web California Rules For Mortgage Interest Deduction In the state of California they use the same value that is on an individuals federal tax return.

Ad Compare the Best House Loans for March 2023. Web Home equity loans sometimes called second mortgages are offered by a variety of mortgage lenders and let you access the equity you have built up in your. Web Best Home Equity Loan Rates Best For Lowest Starting Rate Old National Bank 50 Compare Rates Compare rates from participating lenders in your area via.

Web Many California homebuyers who purchased their California homes with 35 down payment FHA Loans or 5 down payment Conventional Loans have seen. Home equity loans allow. With todays interest rate of 712 a 30-year fixed mortgage of 100000 costs approximately 673 per month in principal and.

Web Federal law limits deductions for home mortgage interest on mortgages up to 750000 375000 for married filing separately for loans taken out after December 15 2017 and.

2424 50th Ave N Lot 57 Saint Petersburg Fl 33714 Mls 11147028 Zillow

What Happens If You Miss A Mortgage Payment Credible

What To Do If You Can T Afford Closing Costs Freeandclear

3805 Linden Ave Long Beach Ca 90807 Zillow

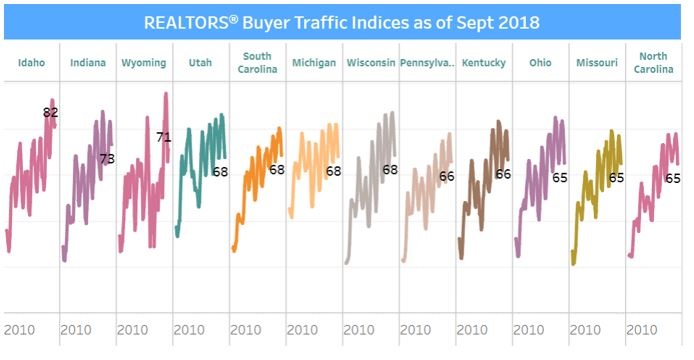

Homebuying Demand Still Strong In Job Creating Affordable States According To Nar September 2018 Survey

4703 Kraft Ave Valley Village Ca 91602 Mls Sb22230706 Redfin

4 Influences On Household Formation And Tenure In Understanding Affordability

Is A Home Equity Loan A Good Idea Know The Pros And Cons Cnet Money

In California Can You Deduct Interest On A Second Mortgage

North America Mortgage Banking 2020 Convergent Disruption In The Cre

Su Casa Southwest Homes Spring 2021 Digital Edition By Sucasaabqsf Issuu

The Coast News October 28 2022 By Coast News Group Issuu

Home Equity

Housing Markets With Highest Share Of Equity Rich Households Undergo Biggest Corrections The Business Journals

Housing Markets With Highest Share Of Equity Rich Households Undergo Biggest Corrections The Business Journals

Why It S Time To Buy California Real Estate Again

Interest On Home Equity Loans Is Still Deductible But With A Big Caveat The New York Times